Roche: Where NGS Goes To Die...

Much of the skepticism around Roche’s new Nanopore sequencer likely comes from a string of failures in the next-gen sequencing space.

As Alex Dickenson recently put it Roche has a reputation of being “where NGS technologies go to die”. Alex is far from the only person to voice this opinion and it’s not entirely unjustified.

Let’s take a look at the history of Roche in NGS!

454

Roche acquired what is generally considered the first next-generation DNA sequencer to launch (454) and then shut it down 6 years later.

This is where a lot of the negativity toward Roche comes from. Many people think they dropped the ball, didn't do enough to accelerate the R&D around 454 and generally didn’t make a serious effort here.

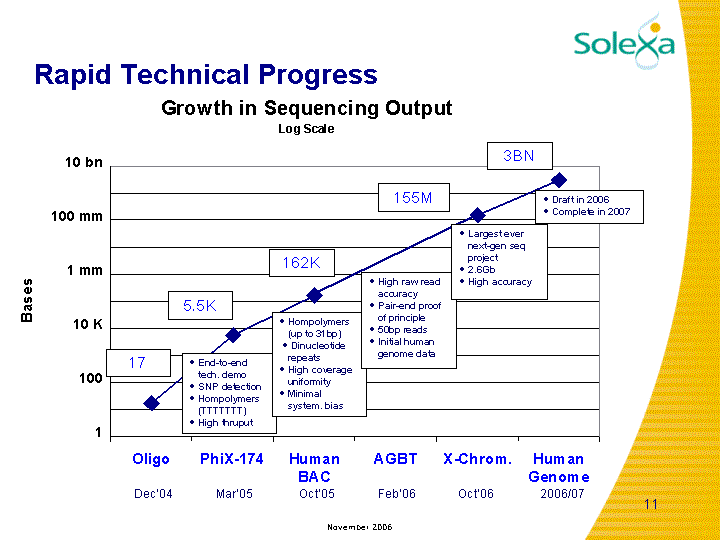

Blaming 454’s failure on Roche isn’t entirely fair. Prior to the acquisition it was already becoming clear that others (specifically Solexa) were showing rapid technical progress.

Solexa (acquired by Illumina) quickly surpassed 454 in terms of throughput:

The Genome Analyzer (first generation instrument) throughput rapidly increased to up to 25Gb, in comparison the 454 FLX+ could barely generate 1Gb of data.

454 however, could generate longer reads (in the 500bp range) compared to the short 75bp reads of the Solexa instrument…

But the bulk of the market was interested in large human genome resequencing projects like the 1000 Genomes project. Resulting in genome centers purchasing 10s of Illumina Genome Analyzers to run in production environments.

This resulted in 454 instruments being pushed into niche applications, like bacterial sequencing. Which Roche was likely less interested in…

Technologically, it wasn’t really possible to scale the 454 approach to be competitive with Illumina… so they just killed it.

Roche Attempts To Acquire Illumina

Around the same time they were shutting down 454 they were also trying to acquire Illumina. The 2012 hostile takeover attempt failed, but seems like a clear indication that they’d given up on 454 by that point. The $5.7B bid was turned down, and given Illumina’s current market cap of $21B this seems like the right decision.

This failed takeover attempt didn’t do much to improve Roche’s reputation.

“Investments”

In parallel with 454 and their attempts to buy Illumina Roche also engaged in a number of “investments” many with a view to try and technologically leapfrog over the current generation of DNA sequencing platforms.