A couple of people objected to my use of the word “failing” in my previous article. I’ve therefore updated it to suggest that they share price is more… gracefully declining.

However I thought it might be interesting to investigate “failure” a little more closely.

Where Are Oxford Nanopore At?

Based on their recent JPM presentation Oxford Nanopore have 467M GBP in cash on hand1.

They also burnt 70.1M in H1 2023. This seems consistent with their loss for 2022 (see below). So at a loss of 140M a year Oxford Nanopore has ~3.5 years of runway.

That is of course if the UK government or an investor doesn’t give them a large pile of free money. Something that seems to happen reasonably regularly.

Dealing With Loss

In 2022 Oxford Nanopore got 50M for doing nothing as part2 of its contract settlement with the UK DHSC. This has somewhat skewed the accounts, and it’s part of what made the bad news reported on the 9th look somewhat worse.

The lower two plots (in green) show the total revenue/loss3.

2023 full year loss hasn’t yet been reported so it’s estimated from H1. But you can see there’s a big jump in Oxford Nanopore’s total loss from 2022 to 2023. Similarly, for the first time total revenue dropped in 2023.

The upper two plots (in blue) show the revenue/loss with that 50M in free money subtracted out. From this we can see that the 2023 loss is pretty much in line with 2022.

Actual growth is much clearer too. We can see some big spikes early on, which I assume is every genomics researcher on a planet scrambling to get papers out using a new platform. But from 2021 growth has been much slower… and not really accelerating:

So, ONT growth seems to be floating around between 10 and 17%... We can contrast this with PacBio’s recent announcement of full year revenue growth of 56% in 20234.

Is This What Failure Looks Like?

What is failure? What does it mean to “fail”? Certainly Oxford Nanopore running out of money would generally be considered a failure.

Oxford Nanopore losses don’t seem to be declining significantly. And if we assume revenue growth is ~15% this doesn’t put them in profit5 before they run out of cash, even if we assume all revenue is profit.

However, even in these economically difficult times ONT have received hundreds of millions outside of product sales! People just seem to like giving them cash!

Perhaps they can just keep doing that?

So let’s look at failure from a different perspective and review Oxford Nanopore’s success on their own terms…

Previous Statements - Growth

In their prospectus ONT stated that:

“The Group’s differentiated approach to commercialization is designed to achieve rapid and long-term growth”

You can decide for yourself if the growth figures above meet your definition of “rapid” or “long-term”… but this doesn’t seem like rapid long-term growth to me.

Previous Statements - Accuracy

Here’s what Gordon had to say in a YouTube interview last year:6

“The underlying technology is equivalent in accuracy to the existing mainframe systems, if you like” - Gordon Sanghera ~June 2022

I last looked at accuracy toward the end of 2022 and it seemed to be a long way from the “existing mainframe systems” i.e. Illumina. Oxford Nanopore have made recent claims of improved accuracy and I guess we’ll see if that pans out.

But personally… no. I don’t think you can really claim “equivalent” accuracy at this point. Which is fine… you can do a number of things that Illumina (or PacBio) can’t do (direct RNA, ultra-long reads).

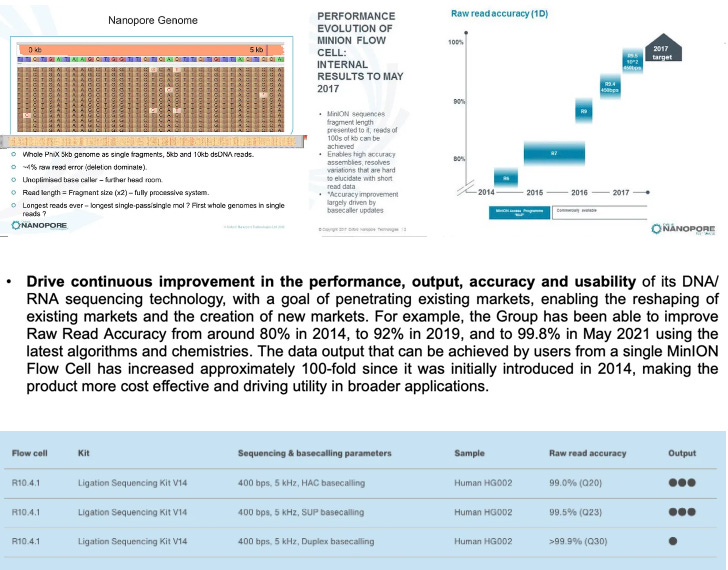

ONT accuracy claims are all over the place… using non-standard metrics and seemingly constantly shifting. “~4% raw read error” in 2012, “Raw Read Accuracy from around 80%” in 2014, “99.8% in May 2021”. And currently on their website 99%, 99.5% or >99.9%. It’s never clear how these accuracies are measured, using what filtering approaches, or at what effective instrument throughput.

And whenever I go and check for myself… the numbers don’t really hold up.

Previous Statements - Illumina Beating

“I was surprised, have been surprised, how hard it has been. And what I’ve realized in the last twelve months is in order to move past Illumina, the customers out there today need to be able to see exactly what they already see with their existing system.” - Gordon Sanghera ~June 20227

So clearly Oxford Nanopore have framed themselves as an Illumina beater. And based on Gordon’s statements (and their relatively small market share) they’ve so far seem to have failed in this regard.

Can they make this happen? Hey, who knows! Perhaps as Gordon says:

“…all the features and benefits we have, will.. people will vote with their feet over time. It takes… it’s taken longer than I thought it would to get commercial traction and acceptance…”

But their current growth trajectory doesn’t suggest it…

Perhaps in addition to the advice I posted yesterday the best bet is to get someone to give you another pile of cash and buy yourselves more time.

Previously this said the following, I updated with this more accurate (but substantially similar) information. Here’s what I previously wrote:

Oxford Nanopore had 484.6M GBP in cash on hand at end of H1 2023. They received an investment of ~70M in H2 2023. Which would suggest they currently have about 480MGBP.

See the various articles on the settlement agreement for a definition of what “doing nothing” means. But my interpretation of the agreement is that they didn’t have to supply any product and this money terminated the agreement any any requirement to provide further services.

I used the adjusted loss for 2021, which they state “ Adjusted operating loss: Loss from operations adjusted for i) Share-based payment expense on founder LTIP ii) Employers’ social security taxes on pre-IPP awards; and iii) IPO costs expensed in Income Statement”. This seems like the right number to use if you want to look at the loss from operations.

Which I’m not going to be investigating in detail here.

Quotes from here.

“6 months ago”: “The underlying technology is equivalent in accuracy to the existing mainframe systems, if you like”.

“The whole field for the last 15 years has been dominated by one monopolising market leader. So it makes it very difficult to topple them because they are so, such a big, powerful voice. I was surprised, have been surprised, how hard it has been. And what I’ve realized in the last twelve months is in order to move past Illumina, the customers out there today need to be able to see exactly what they already see with their existing system. That sounds very obvious now, but I was surprised by that. My expectation was that once we showed them so much more and all this richness of content, they would move towards our technology. But it’s been absolutely clear that you need to be able to give them what they already get from their existing systems and then add value. And that’s something that’s kind of happened since we launched our latest kits and upgrades, which was a year ago now, so but it’s still very challenging to get that, you know, voice heard in a single, you know, monopolising, market leading dominant player. And that’s why some of the lower middle income countries adopting the technology has been a rich source of growth for us and why Asia Pacific is quite important to us. Of course, in Asia Pac, we have BGI, which is the Illumina equivalent. So there are two very big beasts that we’re taking on, but all the features and benefits we have, will.. people will vote with their feet over time. It takes… it’s taken longer than I thought it would to get commercial traction and acceptance because there is one dominant, clear voice out there.”

See above

Emirati Genome Project is apparently stretching its timelines - less near-term ONT revenue

https://otp.tools.investis.com/clients/uk/oxford_nanopore/rns/regulatory-story.aspx?cid=2700&newsid=1746845