Some Thoughts On 10X Genomics

Summary: I expect limited growth in single cell for 10X. Spatial seems interesting but currently small. They produce interesting research tools, but I’m not sure how they would grow to billions in revenue in the longer term.

I’ve been spending some time thinking about 10X Genomics…. recently pulling apart and documenting Chromium Controller (single cell instrument). And more recently spending a little time understanding what’s going on with the Visium HD.

Today I spent a little time looking through some recent announcements, financials and litigation. Here are my (incomplete) thoughts on 10X…

Single Cell versus Spatial

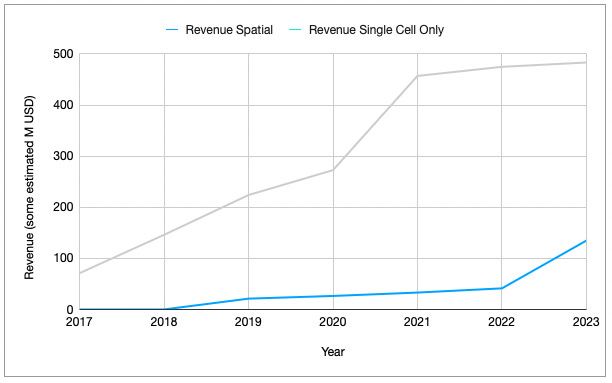

The first thing I wanted to look at was the breakdown of spatial and single cell revenue. 10X reported this in their preliminary 2023 results. Spatial is still a relatively small fraction of their revenue but it seems to be increasing. It appears to be around 20% of revenue at present. In 2022 they reported that it was ~8% of revenue.

There are two ways the 10Xs spatial revenue fraction could be increasing:

Spatial growth could be increasing.

Single cell growth could be slowing down.

From what I can tell it’s a combination of both these factors:

In the graph above I’ve tried to estimate revenue from single cell and spatial. You can find full details in the spreadsheet below. To me it looks like single cell growth is flattening off. And significant spatial growth occurred in 2023.

It’s interesting to note that spatial revenue was also skewed toward instruments in 2023… this may have come from sales of their Xenium instrument.

Single Cell Thoughts

So, it doesn’t seem like there’s much growth in single cell. It remains and interesting an important research tool of course. However, I wouldn’t expect too much growth in, for example, clinical applications.

The 10X IP around single cell seems… complex. Based on the original Biorad droplet IP (now cross licensed to 10X). I would assume a competitor would be able to release a droplet based single cell instrument in 2028.

We’re also starting to see a number of other competitors appearing in single cell.

Even so, I suspect 10X may be able to retain a large chunk of this market. I’m less certain that they’ll see massive future growth here however.

Spatial - Sequencing

Spatial seems like it has more growth potential.