The Bull Case For Sequencing

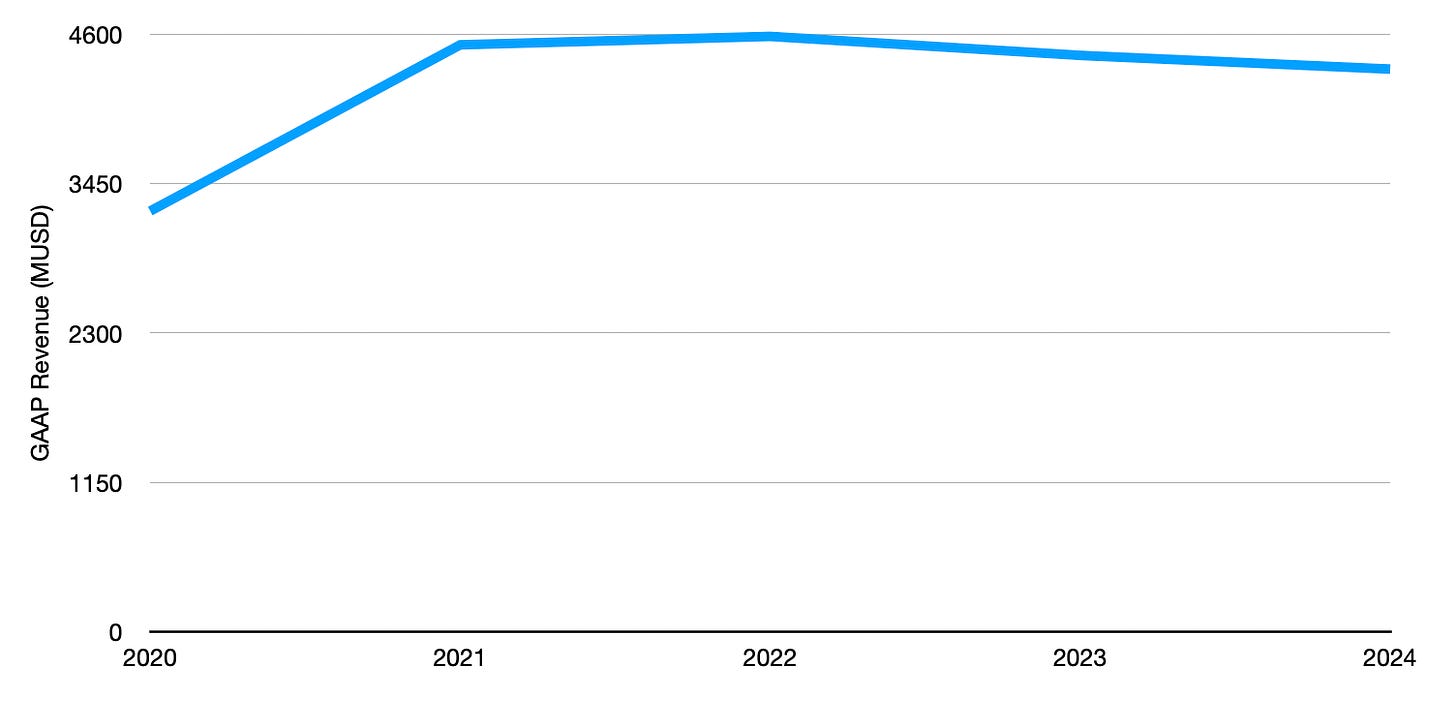

The sequencing market has been somewhat muted recently. This is driven by a few factors. The most significant is Illumina’s stagnant revenue.

The other factor is the poor performance of competitors entering the space:

Element Biosciences, gaining limited traction.

Singular Genomics failure.

Omniome being acquired and shutdown by PacBio.

The failure of long read companies (Oxford Nanopore and PacBio) to show significant growth.

Illumina’s financials however suggest that the market could return to growth. While research revenue has been in decline, clinical revenue growth appears to have been relatively strong:

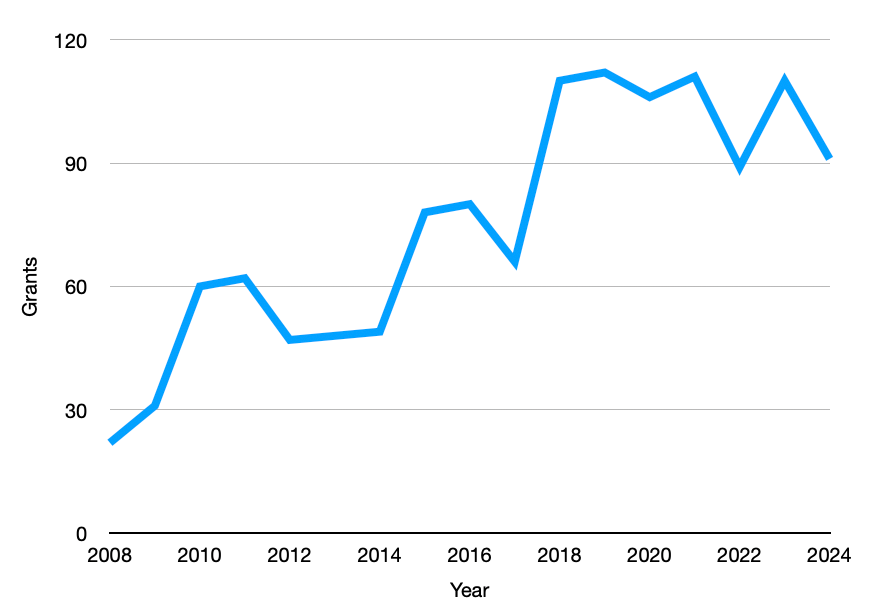

I don’t fully understand that decline in research revenue1. It doesn’t seem to be entirely backed up by an overall decline in research spending over that period. I went to grants.gov and tried to see if I could find anything specifically in genomics. The best trend I could get that supported a leveling off in funding for DNA sequencing projects is this for “sequencing”:

Hardly systematic, but this seems to support a leveling off in sequencing projects. I suspect part of this is explained by an explosion sequencing project starting with the launch of the first NGS sequencer that really scaled (the Genome Analyzer 2 in 2009). Leading to a huge amount of research funding as everyone rushed to get “the first complete genome of X” paper published.

Followed by a leveling off in demand as all the low hanging fruit, high impact projects disappeared.

What will be interesting to see is if this research decline continues at the same pace in 2026. If it does, it seems like we can expect a few more years of slow revenue decline for Illumina (or at least, minimal growth) as the clinical growth doesn’t compensate for the research decline:

Returning to growth in 2027, or perhaps if we’re lucky and the research decline stabilizes, 2026.

Overall, this seems like a stable growth opportunity for Illumina2. And more generally, there is still growth in the sequencing market.

The spreadsheet data is available here. A screenshot of the relevant data is below for reference, 2026 and beyond estimates are just extrapolating the current trend, and my verification method was “those lines look roughly like they’re following the historical trend” a more complete model would be interesting and most welcome.

Of course external factors, like Roche’s new sequencer which will launch next year will have an impact on Illumina specifically. In the short term that’s likely to hit research more than clinical. But with Roche having strong clinical routes, it is likely to have an impact here too.

Working in a sequencing lab in sales I am convinced that sequencing is reaching commodity status. At least WGS/Exome/RNA-seq are requested at lowest prices possible. The quality of data is somewhat similar across companies. Also grants for simple Exome or WGS studies have declined. In Europe at least you get grants for newer tech (spatial, single cell, epigenome etc). Illumina is betting on using NVX as a master tool for all of these. Even clinical which will expand, is a market that wants lowest prices. Sequencing labs will not be making money from tech like Axelios, but the producers of the technology will.

Aren’t ONT talking about another ~23-24% growth versus pacb -8%, hard to see them in the same bucket ?